Budgeting for Entrepreneurs takes center stage in the world of business, offering a crucial roadmap to financial success. Dive into the essentials of budgeting and unleash your entrepreneurial potential with savvy financial management.

Importance of Budgeting for Entrepreneurs

Budgeting is like the secret sauce for entrepreneurs, yo! It’s the backbone of financial planning that keeps a business on track and helps it grow steadily. Without a budget, entrepreneurs might as well be lost in a maze without a map, feel me?

Impact of Effective Budgeting

Creating a solid budget ain’t just about crunching numbers, it’s about making informed decisions, aight? Check it:

- Helps in setting clear financial goals and targets, guiding the business towards success.

- Allows entrepreneurs to allocate resources wisely, preventing overspending and ensuring profitability.

- Provides a roadmap for monitoring cash flow, identifying areas of improvement, and staying ahead of financial challenges.

Benefits of Budgeting for Entrepreneurs

Budgeting ain’t just about restrictions, it’s about empowerment, fam! Peep these benefits:

- Enhanced financial control and transparency, leading to better decision-making.

- Encourages strategic planning and risk management, reducing uncertainties and increasing business resilience.

- Improves credibility with investors and lenders, showcasing a commitment to financial discipline and long-term sustainability.

Creating a Comprehensive Budget

Budgeting is a crucial aspect of running a successful business as an entrepreneur. A comprehensive budget helps you track your financial health, plan for the future, and make informed decisions. Let’s delve into the essential components of a business budget, different budgeting methods suitable for entrepreneurs, and tips on setting realistic financial goals within a budget.

Essential Components of a Business Budget

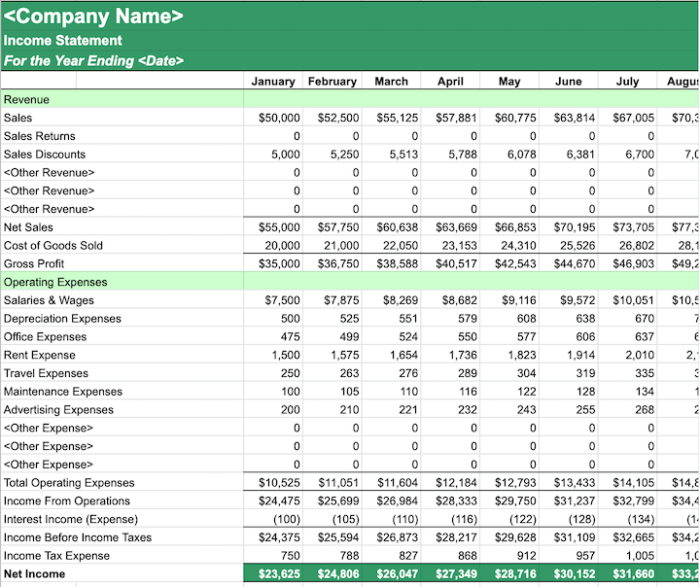

- Revenue Projections: Estimate your income streams and sales forecast.

- Expenses: Include all your business expenses such as rent, utilities, salaries, and supplies.

- One-Time Costs: Account for any significant one-time expenses like equipment purchases or marketing campaigns.

- Contingency Fund: Set aside a portion of your budget for unexpected expenses or emergencies.

Different Budgeting Methods for Entrepreneurs

- Zero-Based Budgeting: Start from scratch each month and allocate funds based on your current needs and goals.

- Incremental Budgeting: Build on the previous period’s budget, making adjustments based on changes in your business.

- Activity-Based Budgeting: Allocate funds based on the activities that drive revenue in your business.

- Value-Based Budgeting: Focus on allocating resources to activities that add the most value to your business.

Tips for Setting Realistic Financial Goals

- Set Specific Goals: Define clear and measurable financial objectives for your business.

- Consider Your Business Cycle: Align your financial goals with the seasonality of your business.

- Track Your Progress: Regularly monitor your budget and financial performance to stay on track.

- Seek Professional Advice: Consult with financial experts or mentors to help you set achievable financial goals.

Monitoring and Adjusting Budgets

Regularly monitoring a budget is crucial for entrepreneurs to stay on track with their financial goals and make informed decisions. By keeping a close eye on expenses and revenue, entrepreneurs can identify potential issues early on and take necessary actions to prevent financial setbacks.

Strategies for Tracking Expenses and Revenue

Effective tracking of expenses and revenue involves using tools like accounting software or spreadsheets to record all financial transactions accurately. Entrepreneurs should categorize expenses and revenue streams to have a clear understanding of where money is coming from and where it is going. Additionally, setting up regular financial reviews can help in identifying any discrepancies and adjusting the budget accordingly.

- Utilize budgeting apps or software to track expenses in real-time.

- Maintain organized records of receipts and invoices for easy reference.

- Compare actual expenses and revenue against the budgeted amounts regularly.

- Conduct a monthly financial review to analyze trends and make necessary adjustments.

Adapting Budgets to Changing Circumstances

Entrepreneurs should be prepared to adapt their budgets to changing circumstances such as unexpected expenses, revenue fluctuations, or market shifts. Flexibility is key in budgeting, and being able to adjust spending priorities or revenue projections can help in maintaining financial stability and achieving long-term business success.

- Identify areas where expenses can be reduced or reallocated to accommodate changes.

- Explore new revenue streams or business opportunities to offset any financial challenges.

- Seek advice from financial advisors or mentors to gain insights on budget adjustments.

- Regularly revisit and revise the budget based on updated financial data and business performance.

Avoiding Common Budgeting Pitfalls: Budgeting For Entrepreneurs

When it comes to budgeting as an entrepreneur, there are some common pitfalls that you need to watch out for. By identifying these mistakes and learning how to avoid them, you can ensure that your business stays financially healthy and on track for success.

Underestimating Costs, Budgeting for Entrepreneurs

- One common mistake entrepreneurs make is underestimating costs. Whether it’s not accounting for unexpected expenses or failing to research the true cost of materials, underestimating can wreak havoc on your budget.

- To avoid this pitfall, make sure to do thorough research on all potential costs, including hidden fees or price increases. It’s better to overestimate than to be caught off guard.

- Consider creating a contingency fund within your budget to prepare for any unforeseen expenses that may arise.

Overlooking Small Expenses

- Another common budgeting mistake is overlooking small expenses. While they may seem insignificant on their own, these costs can add up quickly and throw off your budget.

- Be diligent about tracking every expense, no matter how small. Utilize budgeting tools or software to help you keep a close eye on where your money is going.

- Review your budget regularly to identify any areas where small expenses are accumulating and find ways to cut back where necessary.

Failing to Adjust the Budget

- A major pitfall for entrepreneurs is failing to adjust the budget as needed. Circumstances can change quickly in business, and if you stick to a rigid budget, you may find yourself in financial trouble.

- Regularly review your budget and make adjustments as necessary. This could mean reallocating funds, cutting expenses, or seeking out new revenue streams.

- Stay flexible and be prepared to make changes to your budget in response to market shifts or unexpected events.