Credit Score Improvement, a crucial aspect of financial stability and success, impacts various life decisions. From securing favorable loan terms to renting an apartment, your credit score plays a significant role. Dive into the world of credit scores and discover how you can enhance yours for a brighter financial future.

Importance of Credit Score Improvement

Having a good credit score is crucial for maintaining financial health. It impacts various aspects of your life, from getting approved for loans to renting an apartment or buying a car.

Higher credit scores can lead to better loan terms and lower interest rates. For example, with a good credit score, you may qualify for a mortgage with a lower interest rate, saving you thousands of dollars over the life of the loan.

Impact on Loan Approval

- Higher credit scores increase the likelihood of loan approval.

- Better credit scores can result in more favorable loan terms, such as lower interest rates and higher borrowing limits.

- A good credit score demonstrates financial responsibility to lenders.

Effect on Renting and Buying

- Landlords often check credit scores when considering rental applications.

- A higher credit score can make it easier to secure a rental property.

- When buying a car, a good credit score can help you qualify for better financing options.

Factors Affecting Credit Scores

Maintaining a good credit score is crucial for financial stability and access to credit. Several key factors influence credit scores, including payment history, credit utilization, and length of credit history. Understanding these factors and how they contribute to your overall credit score is essential for improving your financial health.

Payment History

Your payment history is the most significant factor affecting your credit score. It accounts for about 35% of your total score. Lenders want to see a history of on-time payments, as missed or late payments can significantly impact your credit score. To positively impact this factor, make sure to always pay your bills on time and in full.

Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount of credit available to you. This factor makes up about 30% of your credit score. Keeping your credit utilization low, ideally below 30%, shows lenders that you are responsible with credit. To improve this factor, try to pay down your balances and avoid maxing out your credit cards.

Length of Credit History

The length of your credit history makes up around 15% of your credit score. Lenders want to see a long history of responsible credit use. If you are new to credit, it may take time to build a solid credit history. To positively impact this factor, keep your oldest accounts open and continue to use credit responsibly over time.

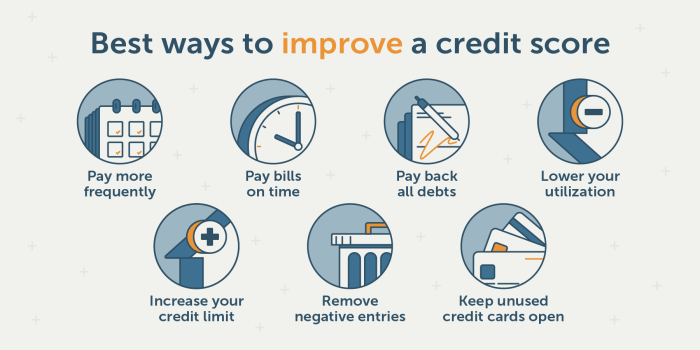

Strategies for Credit Score Improvement

When it comes to boosting your credit score, there are several actionable steps you can take to see real results. Whether you’re looking to pay off debt, dispute errors on your credit report, or use credit-building tools, having a personalized plan in place is key to achieving your financial goals.

Paying Off Debt

- Start by creating a budget to track your expenses and prioritize paying off high-interest debt first.

- Consider debt consolidation to combine multiple debts into one lower-interest payment.

- Make timely payments to avoid late fees and improve your payment history.

Disputing Errors

- Regularly review your credit report for any inaccuracies or errors that could be negatively impacting your score.

- If you find any mistakes, file a dispute with the credit bureau to have them corrected or removed from your report.

- Monitor your credit report regularly to ensure that any disputed errors have been resolved.

Using Credit-Building Tools

- Consider applying for a secured credit card to establish a positive payment history.

- Explore options such as credit builder loans or becoming an authorized user on someone else’s credit account.

- Use these tools responsibly and make timely payments to see a positive impact on your credit score over time.

Monitoring and Maintaining a Good Credit Score

Regularly monitoring your credit score is crucial to staying informed about your financial health. It allows you to track any changes, detect errors, and identify potential fraudulent activities early on.

Tools and Resources for Tracking Credit Scores

- Utilize free credit monitoring services offered by various financial institutions and credit bureaus.

- Consider using third-party apps or websites that provide regular credit score updates and alerts.

- Access your credit reports for free once a year from each of the major credit bureaus through AnnualCreditReport.com.

Tips for Maintaining a Good Credit Score, Credit Score Improvement

- Pay your bills on time every month to establish a positive payment history.

- Keep your credit card balances low and aim to use no more than 30% of your available credit.

- Avoid opening multiple new credit accounts in a short period, as it can lower the average age of your accounts.

- Regularly review your credit reports for errors and dispute any inaccuracies promptly.

- Limit the number of hard inquiries on your credit report by being cautious about applying for new credit.